Embarking on a road trip or simply navigating daily commutes can be stressful without proper car insurance. It's fundamental to select a policy that meets your unique needs and provides thorough coverage. Consider factors like liability limits, deductibles, and the types of coverage you require, like collision, comprehensive, and uninsured motorist protection.

Compare quotes from various insurance providers to obtain the best value for your money. Don't hesitate to seek clarification any terms or conditions you don't comprehend. Remember, having the right car insurance can give you assurance on the road.

- Compare different insurance companies and their offerings.

- Determine your coverage needs.

- Review policy terms and conditions carefully.

Safeguard Your Belongings with Auto Insurance Knowledge

Driving a vehicle is an exciting experience, but it also comes with inherent risks. Accidents can happen unexpectedly, leaving you and your assets vulnerable to financial hardship. That's why understanding car insurance coverage is essential. A comprehensive policy provides a protective shield against unexpected expenses related to accidents. By meticulously examining your coverage options, you can ensure that you're adequately protected in the event of an unfortunate incident.

- Meet

- Research different types of car insurance coverage available in the market.

- Scrutinize your contract details regularly to ensure you understand the terms and conditions.

Obtain a Quote Today: Affordable Car Insurance Options

Are you searching for the best rates on car insurance? Look no further! We offer a selection of reasonable car insurance options to fit your demands. Our experienced agents are here to assist you in finding the perfect policy that gives the security you need at a price you can manage. Don't wait! Obtain your free quote today and start saving.

Check Rates, Save Money: Finding the Best Car Insurance Deal

Shopping around for car insurance can feel overwhelming, but it's crucial to find the most affordable coverage that meets your needs. By analyzing quotes from different insurers, you can potentially save hundreds of dollars each year. Start by using online comparison tools to get instant quotes from multiple companies. Then, meticulously review the coverage details and costs offered by each insurer. Don't hesitate to reach out to insurers directly if you have any questions or need further clarification.

Consider elements like your driving history, vehicle type, and desired coverage levels when making your decision. Remember that the cheapest option isn't always the best. It's important to choose a policy that provides adequate protection for you and your assets. By being diligent and researching your options, you can here obtain the most cost-effective car insurance deal available.

Navigating Car Insurance Claims: A Step-by-Step Guide

Filing a car insurance claim can feel overwhelming, especially after an accident. But with a little organization and knowledge, you can easily navigate the process. Here's a step-by-step guide to help you through: First, contact your insurance company as soon as possible to report the accident and provide all necessary details. Next, collect evidence like photographs of the damage and witness information. Cooperate your insurer throughout the investigation process by replying promptly to their requests for information. Once the claim is assessed, you'll receive a settlement offer. Carefully review the terms and negotiate any discrepancies with your insurer before accepting. Remember to keep detailed records of all communications and documents related to your claim.

- Confirm your insurance policy covers the damages incurred in the accident.

- Consider legal advice if you face difficulties with your insurer or have complex claim issues.

Auto Insurance Basics: What Every Driver Should Know

Driving a car is a necessity in today's world.

However, it also comes with certain requirements, the most important of which is having adequate auto insurance coverage. Auto insurance helps protect you economically if you are involved in a car accident or other unexpected event.

There are several types of auto insurance coverage, each providing varying levels of protection. It's important to understand the basics of these coverages so you can choose a policy that meets your needs.

- Liability coverage

- Comprehensive Coverage

- Medical payments coverage

This article will give you a basic overview of auto insurance and help you establish the coverage that is right for you.

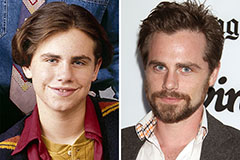

Rider Strong Then & Now!

Rider Strong Then & Now! Taran Noah Smith Then & Now!

Taran Noah Smith Then & Now! Yasmine Bleeth Then & Now!

Yasmine Bleeth Then & Now! Andrew Keegan Then & Now!

Andrew Keegan Then & Now! Dawn Wells Then & Now!

Dawn Wells Then & Now!